Account: Blog backtesting 2013 Apr start

On Oct 25, 2013 the market was down and Average IV was 13.7% at the time of entry around 10:30am.

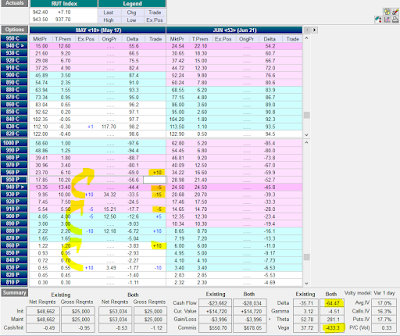

Trade entry:

Adjustments:

- Oct 31 - Sold 5 x 1080 to protect t+0 downside risk

- Nov 1 - Sold 5 x 1070 to protect t+0 downside risk

- Nov 4 - Sold 5 x 1110 to protect t+0 upside risk

- Nov 6 - Sold 3 x 1060 to protect t+0 downside risk

- Nov 7 - Rolled BF down 40 pts b/c can't keep DELTA and VEGA negative

- Nov 8 - Sold 10 x 1060 to reduce - DELTA outside tent

- Oct 25 - There was a volatility hit which resulted in market makers taking the price out of my butterflies. As a result my absolute loss (ABS Loss) was increase to -$4000

- As a result of an increase in ABS Loss, my threshold when assessing t+0 line will be $1500 - $1800

- Sold 5 x 1060 to protect t+0 upside risk

- Nov 15 - Sold 5 x 1070 to increase - VEGA

- Nov 21 - Rolled the BF up 40 pts b/c can't keep VEGA and DELTA negative

- Nov 22 - Sold 10 x 1110 to reduce - DELTA inside edge of tent

- Nov 25 - Sold 4 x 1120 to protect t+0 upside risk

- Nov 26 - Sold 6 x 1120 to control - DELTA outside tent

- Dec 3 - Sold 5 x 1110 to protect t+0 downside risk

- Dec 6 - Sold 5 x 1120 to reduce - DELTA inside edge of tent

- Dec 11- 9 DTE left exited this trade for a slight profit + $315 < In a real trade I probably would have taken profits here.

Continued to trade this to 7 DTE

- Dec 12 - Sold 10 x 1100 to reduce + DELTA inside tent

- Dec 13 - Sold 10 x 1110 to reduce - DELTA inside tent

- Dec 14 - 7 DTE and exited the trade for a slight profit of + $975