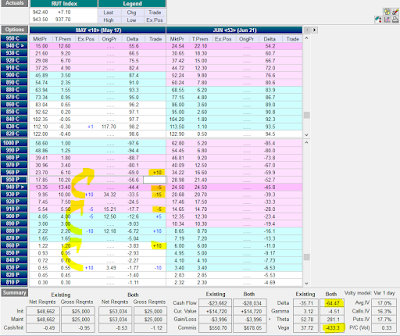

On Mar 22, 2013 the market was slightly up and Average IV was 14.3% at the time of entry around 10:30am.

Trade entry:

Adjustments:

- Apr 3 - Sold 10 x 920 to reduce + DELTA under tent

- Apr 9 - Sold 5 x 930 to protect t+0 upside risk

- Apr 10 - Sold 5 940 to reduce - DELTA and protect t+0 upside risk

- *NEW adjustment* - Discarding below adjustments, I did the below adjustments to see if I could minimize my drawdown, but in fact I made it worse. I've traded this position twice now and I can't pull it out of a greater than Max Loss situation, therefore I've realized that if I have a drawdown that is greater than my Max Loss (-$2500) around -$3500, its better to just close the trade.

- Apr 15 - Exit trade for above MAX Loss - $3465

Apr 15 - Rolled the BF down 40 pts

Apr 15 - there was a sharp down move of -35 pts in the RUT, this volatility hit resulted in market makers taking the price out of my butterflies. As a result my absolute loss (ABS Loss) was increase to -$4000 to $ -5000As a result of an increase in ABS Loss, my threshold when assessing t+0 line will be $1500 - $2000Apr 15 - Sold 8 x 890 to protect t+0 upside riskApr 16 - Sold 8 x 900 to protect t+0 upside riskApr 18 - Sold 2 x 870 to protect t+0 downside risk (doesn't protect me from my MAX loss of $5000, just hanging in there to minimize my loss through adjustments + BREACHED MY MAX LOSS & KEPT ON MANAGING THE TRADE)Apr 19 - Sold 2 x 910 to protect t+0 upside riskApr 22 - Sold 2 x 890 and 1 x 910 to flatten out t+0 and protect upside riskApr 23 - Sold 2 x 910 to protect t+0 upside riskApr 29 - Rolled the BF up 30 pts

Apr 29 - Sold 5 x 940 to protect t+0 upside riskMay 1 - Sold 5 x 920 to protect t+0 risk in both directionsMay 2 - Sold 5 x 930 and 5 x 950 to protect t+0 upside riskMay 3 - Sold 3 x 940 and 2 x 950 to protect t+0 upside riskMay 7 - Sold 3 x 950 to reduce + VEGAMay 9 - Exited at MAX LOSS - $ 4806

Very tough trade need to review with Dave.