*Entry Error*

When I put the M3 trade on (April 21, 2017 at 14:36), I purchased the Weekly Call first which got filled immediately. I then tried to put the Butterfly on and couldn't get filled, the market was moving fast and market makers weren't filling my order. 20 mins later after multiple changes to the price I got filled .40 above the mid price.

Fix: ALWAYS enter the Butterfly first, its the part that sometimes takes time to fill, THEN purchase the weekly call.

Adjustments:

- April 24 - Rolled the weekly call to the forward month (from May 5 to May 12 expiry)

- Adjustment error: I should NEVER roll so early in my trade and pay for the roll! Always try to get a credit until the last 2 days of expiry

- April 26 - Went VEGA positive and had to make an adjustment

- April 26 - Rolled the Butterfly up 40 pts

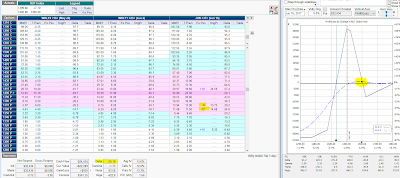

- April 28 - 30 pts down move would result in Max Loss, therefor reduced Butterfly from 13 lot to 10 lot and brought 5 shorts down.

- April 28 - After adjustment

- May 3 - Breached +50 Delta inside tent, therefor I rolled another 5 short strikes down.

- Adjustment error: When we breach +50 Delta we roll the entire Butterfly down. The adjustment I made results in the t+0 line becoming a ball on top of the mound. i.e. Risk on both sides within a 20 - 30 pts move will result in max loss.

- May 5 - Spoke with Dave about my trade and he educated me on the value of not rolling the short strikes down when I reach +50 Delta. He explained that the top of the mound situation and although I may have a higher Theta to make a higher profit target, I would have to more actively monitor this trade to ensure it doesn't get out of hand i.e. sharp move could result in a max loss.

- He recommended that I roll the position down, as a result I was able to take some margin out of the trade and level out my t+0 line.

- May 8 - I had 3 DTE on my weekly call and started getting anxious. I had a Calendar in for debit of 0.05 but never got filled, at the time I looked at it the mark was at 0.10, so I increased my debit to 0.10 didn't get filled and then increased it again to 0.15 and it was sitting there. I then looked at my Analyze screen to see what other strikes or Diagonals were priced at and noticed that for the same price even slightly less I could bring my call up to 1270 for credit of 9.90 (i.e. 0.10 cost to me). I decided to cancel my Calendar and created a Diagonal to move closer to the money.

- This also didn't get filled, so I decided to reduce my credit by 0.15, still no bite, and then I ultimately said my final credit reduction is 0.20. I entered the order and got filled.

- *Note* I should have looked at the 1 min chart to see what the market was doing at the time of my fill attempts, if the market was moving up, I should've waited for a pull back and then placed my order.

- May 10 - Around 15:53 I noticed that I was slightly outside the tent with a minus Delta of -63.05, therefore to bring my Delta outside the tent back in check I moved 8 of my short strikes up to reduce Delta to -20.10

- May 12 - Looking at my T+0 line to the downside, with a 30 pts down move I would hit a loss of -$1910, therefore I pulled 6 of the 8 shorts I previously moved up back to 1360 Strike. This fixed my downside risk at the cost of the upside.

- Dave commented on this adjustment and said that I could have rolled the M3 down to avoid the ball on top of the mound situation, here is his comment:

Getting less negative delta is OK, but, you know that was coming, it comes with some upside issues as you can see by your graph. The biggest issue in my opinion is that you are sitting on the top of the ball. As long as we do not move much you are ok. But again, if we have a big move in either direction, you will get hurt. You could have simply rolled down to 1340. You can still do this. Basically reset your trade or simply take your gain of $1000 or so, and move onto July.

- May 15 - Ended up taking the trade off after commissions for a final profit of $863 after commissions.