Daily Trading Journal

- July 25 - Noticed that my t+0 to the upside was sagging a bit and a 30 pts move up would result in -$1042. Therefore I decided to adjust my position using a condor adjustment strategy.

- Question: Should I have made this adjustment considering my Greeks were in check and it is so early in the trade?

- After making the adjustment my upside with a 30 pts move -$774 AND 30 pts down move -$625

- Jul 31 - Checked position DELTA & VEGA both are good. T+0 line is great also in 30 pts right/left.

- I think that the market is going to rebound, b/c the market makers haven't taken all the value out of my position, contrarily I'm up in my position which is nice to see. What I think this is telling me is that the market makers believe that this dip is a slight pullback and the market will bounce.

- Jul 31 - Concerned about my call and when to roll, I would have thought that with this down move that the calls would have become cheaper to roll, but that has not been the case.

- Aug 1 - Checked position DELTA & VEGA and both are good. T+0 line is great in 30 pts right/left.

- Concern about rolling my call, everything is still fairly expensive, will wait till Thursday to roll my call.

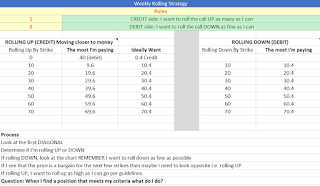

- Trying to get within these rules:

- Aug 2 - Checked position DELTA & VEGA and both are good (Delta was borderline for an adjustment 49.42). T+0 line is great in 30 pts right, but 30 pts to the left brings me to max loss.

- 20 pts move to the left (i.e. down) results in -$1250, which I'm ok with. Therefore making a judgement call based on the fact that on a large down move the highest probability for the RUT is there "might" be a rebound.

- Aug 3 - Position DELTA was not good (Delta = +80 Delta). T+0 line sloping down.

- Decision: Roll M3 down 40 points, I was worried about doing this b/c I felt as I would be paying a premium to roll the position on a down day.

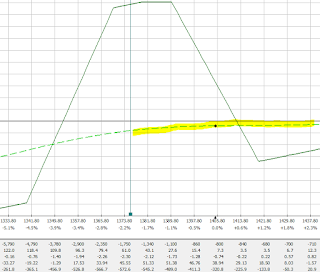

- After rolling the M3 down 40 pts I moved half of my short strikes up into a +10 -10 -10 +10 M3 position, but when I look at my T+0 line 30 pts to the right (up) my t+0 was sagging

- Therefore I ended up moving some more shorts up to maintain a "relatively" T+0 to the upside (i.e. right analyze graph) and protected 20 to 30 pts down (i.e. left of analyze graph 30 pts move = -$1554)

- Question for Dave: How can I bring my position out from under the $0 axis?

- If I add butterflies will that help bring my position above the $0 axis?

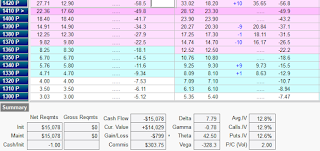

- Aug 4 - The RUT bounced today position DELTA / VEGA was good (Delta = + 0.62 Delta). T+0 line was flat to the upside and 30 pts downside within -$1250 (actual greek trend -$1147).

- Decision: I found myself trying to increase my butterflies to take advantage of my Option Buying Power (I don't know how my M3 ended up being a $15,078 position size when every other time its closer to 18 or 20k) and an increase in volatility.

- I couldn't figure out how to increase my position size without messing up my T+0 line.

- Need to ask Dave or John how to achieve this.

- Aug 7 - RUT was up 2.21 pts.

- DELTA / VEGA are both good.

- T+0 is relatively flat to upside and we are protected with a 30 pts down-move (-$750)

- Aug 8 - RUT was up 0.46 pts.

- DELTA / VEGA are both good.

- T+0 is relatively flat to upside and we are protected with a 30 pts down-move (-$936)

- Aug 9 - RUT dropped -16.80 points

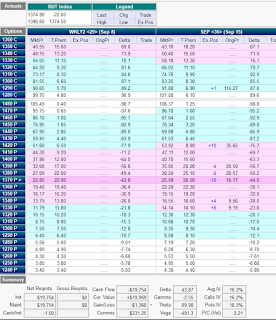

- 10 am - Decided to roll my weekly call into the same expiry month as the butterfly, it was getting too complicated having to roll my weekly call. Hence, I decided to make my trade simpler for the time being and managing adjustments using Condors.

- T+0 line: 30 pts down move will exceed -$2500 max loss

- Ended up rolling using condor adjustment 5 from 1390 to 1380 and 5 from 1340 to 1330.

- Aug 10 - RUT was down - 22 pts

- Ended up rolling down 4 from 1390 to 1380 and 4 from 1340 to 1330

- Aug 14 - RUT up +18.6 pts

- T+0 line was sagging to the upside and therefore made an adjustment

- Made adjustment using condor strategy, moved 10 x 1380 to 1390 and 10 x 1330 to 1340

- Aug 17 - RUT was down - 20 pts and DELTA was +119.

- Made an adjustment to sell 5 call verticals in order to control Delta, while the market is going bonkers.

- I also moved using a condor strategy 10 x 1420 to 1410 AND -10 x 1370 to 1360

- Had a conversation with Dave and he mentioned that if we have another down move that I should exit my position to limit my losses with the following steps:

- Close call

- Close condor

- Close vertical

- Aug 18 - BIG Mistake, at market open RUT was pulling back and I decided to exit the position. IF i had waited till noon or 3:30pm then I could have stayed in the trade and not lost as much money as I did.

- Exited at -$1397 loss.